The Chinese government has intensified administrative measures to control coal imports since 2017, issuing import quotas to individual customs and major importers. The country's coal imports remained robust in the first eight months this year, but may not be sustained in the rest months.

While it is clear China wants to keep coal import flat from last year, Sarah Liu, vice president of China-based coal consultant Fenwei Energy Information Services Co., Ltd., pointed out the target for 2019 will be hard to achieve, and the full year imports may reach 300 million tonnes, increasing some 20 million tonnes from 2018.

Speaking at Coaltrans Japan in Tokyo on September 17, Sarah did expect sharp fall in China's coal import to reoccur in the fourth quarter, just like last year.

China's coal imports stayed high in both July and August, and the major drivers, according to Sarah, are effort to secure coal supply in peak season, price gap between domestic and imported coal, and end users' strategy to diversify resources.

Customs data showed China imported 220 million tonnes of in the first eight months, up 8% year on year. Aug import hit the second high in 2019 at 32.95 million tonnes, just slightly lower than January's 33.5 million tonnes.

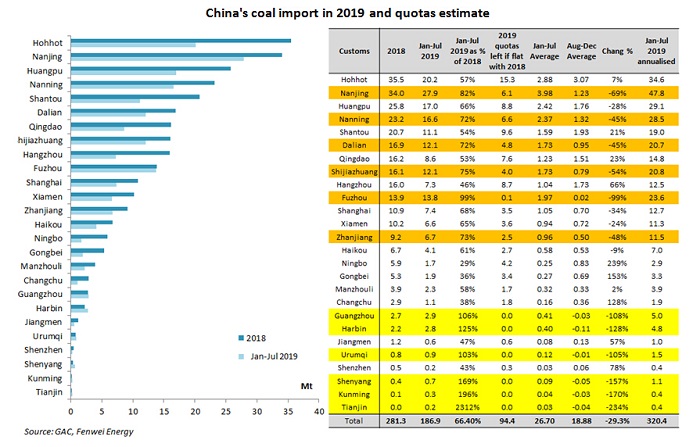

If China is serious in controlling imports, there would be only 61-million-tonne quota left for September-December. And the average monthly imports in the September-December period would reduce to 15.3 million tonnes from 27.5 million tonnes of January-Aug, down 44%.

It was learned some southern coastal ports in China have run out of this year's import quotas. While the restrictions are mainly targeting imports of thermal coal, coking coal imports are also affected. And imports by traders are more restricted than end-users.

At some northern ports like Jingtang in Hebei province, only local utilities as end buyers could continue to clear customs for overseas coal, while traders were rejected.

The tight import quota has caused big concerns of intensifying restriction and declining imports in the remaining months and has caused declines in seaborne coal market, though prices have been range-bound in the past month.

On September 19, Fenwei assessed Indonesian 3,800 Kcal/kg NAR coal price at $42.9/t CFR South China, up $3.4/t month on month but down $3.9/t year on year. Indonesian 4,700 Kcal/kg NAR coal price was assessed at $56.5/t CFR South China, rising $0.8/t from the month prior yet down $5.5/t from a year earlier. Australian 5,500 Kcal/kg NAR coal price was assessed by Fenwei at $63.6/t CFR South China on the same day, an increase of $0.3/t from a month ago despite a year-on-year decrease of $1.3/t.

China has adopted restrictive measures on coal imports since 2017, and vowed to cap imports in 2018 at the level in 2017. But figures showed that China's coal imports in 2017 and 2018 stilled climbed further to 271 million and 281 million tonnes respectively, from 256 million tonnes in 2016.

China often uses multiple tools to control coal imports, including tariff, quality requirement, import quota, as well as clearance procedure control, Sarah introduced.

"It is expected the import restriction policy will be in place for relative long time, with the main purpose is to meet domestic demand by importing high-quality coal, to ensure import volumes at a reasonable level, to fill the domestic supply gap but not too much to compress domestic supply," she said.

The enforcement can be adjusted periodically based on domestic supply-demand situation, easing when domestic supply is tight and tightening when supply turns loose, according to Sarah.

Imported coal has been on an upward trend in China's total coal consumption, at 5-9% in recent years, Sarah said.Coastal region is the main consumption market for imported coal, with a higher share of 11-17%.

Imported coking coal gained a bigger share at 9-14%, and reached 15-20% for the coastal region. Imported hard coking coal shared the biggest proportion at 12-19% due to short domestic resources, with the coastal region at 21-28%.

China's domestic and seaborne coal markets are closely related. Chinese regulations impact not only domestic market, but also the seaborne market. The impact mainly manifests the change of China's import demand for seaborne coal and thus affects the prices in the seaborne market. Generally, the two markets show consistent trend in price change.

China plays a decisive role in the change of seaborne market prices. This is determined by the fact that China is a marginal buyer in the seaborne coal market. Chinese buyers are highly price sensitive and constantly compare the price gap between seaborne and domestic coal, Sarah said.

"When the price gap narrows, Chinese buyers slow purchase, leading the seaborne price to fall; when the price gap enlarges, Chinese buyers increase purchase to drive up seaborne coal prices," she said.

Fenwei analysts have been closely tracking the Chinese domestic and import market, presenting in-depth analysis and insights in the well-received newsletters Fenwei Coal Weekly Update, China Thermal Coal Market Monthly Report, and China Coking Coal Market Monthly Report.

Contact us for subscription details at +86-351-7219322 or email inquiry@fwenergy.com.

(Writing by Jessie Jia Editing by Harry Huo)

For any questions, please contact us by inquiry@fwenergy.com or +86-351-7219322.

中文

中文